Going through a divorce is one of the most challenging experiences you’ll ever face. And when that process involves selling your family home—the place where you built memories, celebrated milestones, and imagined your future—the emotional weight becomes almost unbearable.

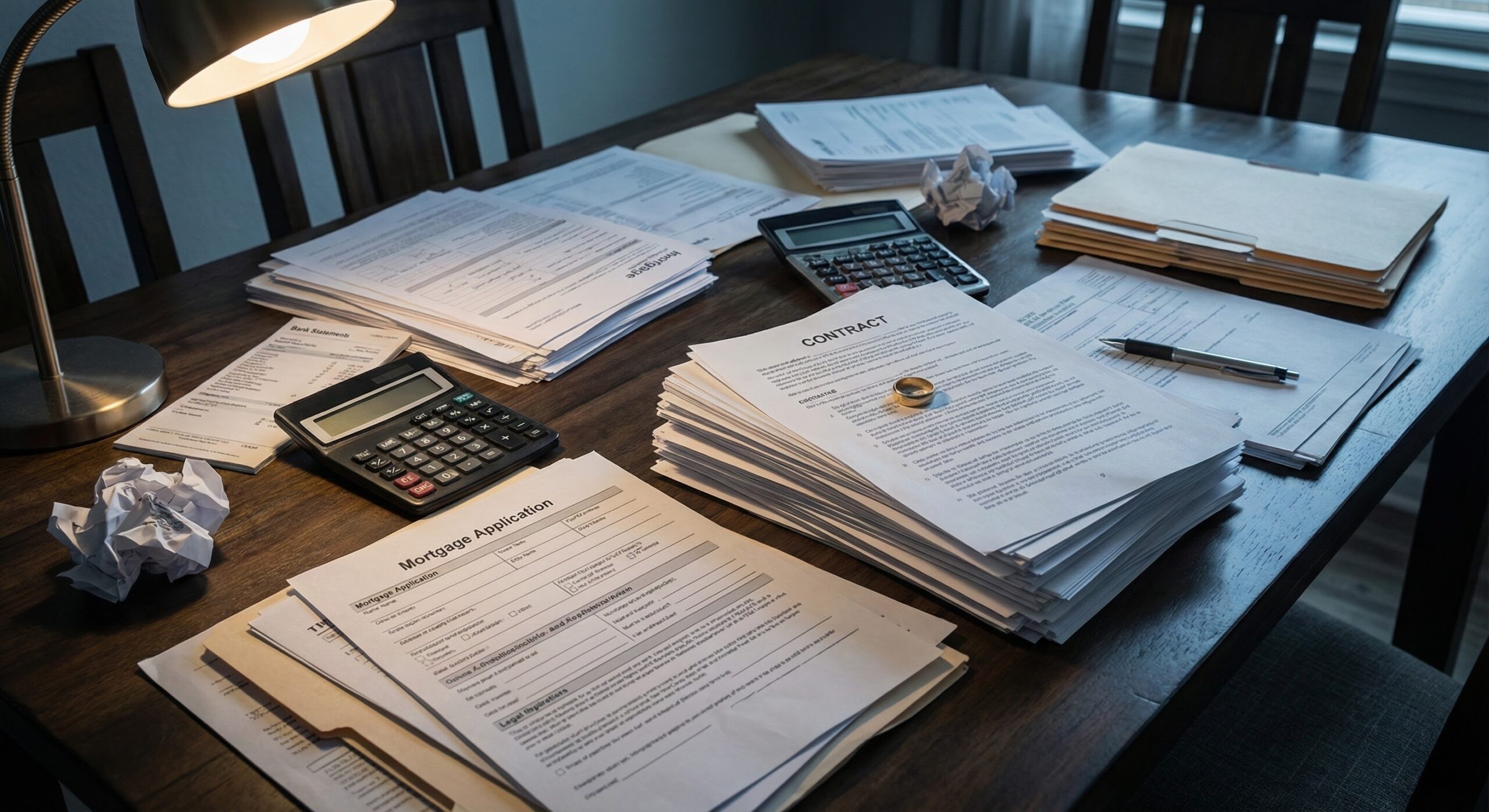

You’re not just dealing with legal paperwork and financial calculations. You’re closing a significant chapter of your life while trying to figure out what comes next. The stress is real, the emotions are raw, and the last thing you need is a complicated, drawn-out home sale adding more conflict to an already painful situation.

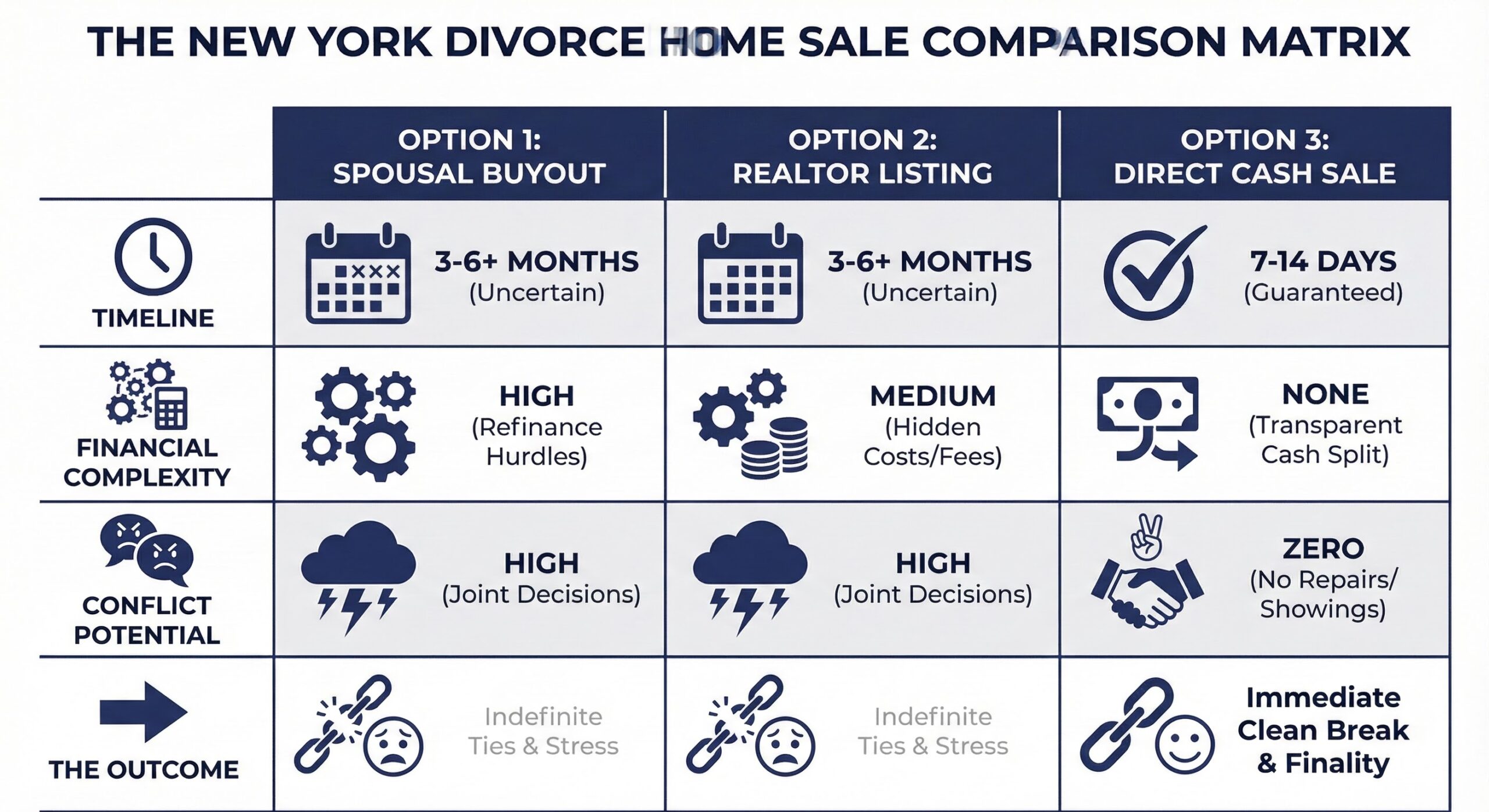

We’ll walk you through the three primary options available to every New York couple facing this situation, and we’ll be honest about the trade-offs between speed, final price, and emotional toll. Our goal is simple: to help you understand which path offers the quickest, most equitable way to finalize your asset division and transition into the next phase of your life.

Option 1: The Buyout – When One Spouse Keeps the Home

When couples first start exploring options, the buyout often seems like the ideal solution. One spouse stays in the home (maintaining stability, especially if kids are involved), while the other gets bought out for their share of the equity and moves on. On paper, it sounds clean and straightforward. In reality? It’s rarely that simple, especially in New York.

The Challenge: Divorce Refinancing is Harder Than You Think

To complete a buyout, the spouse who’s staying must qualify for a new mortgage in their name alone. This means refinancing the existing loan to remove the other spouse from both the mortgage and the title. Sounds doable, but here’s where it gets complicated:

- Income Qualification Just Got Tougher: After the divorce, lenders only consider the income of the person applying for the new loan. Meeting the bank’s debt-to-income ratio requirements becomes significantly harder on a single income.

- The Alimony and Child Support Waiting Game: Most lenders require proof that alimony/child support payments have been received consistently for at least 6 months to 2 years before they’ll factor them into the loan qualification.

- The Equity Buyout Hurdle: The new loan needs to be large enough to cover the existing mortgage balance and pay the exiting spouse their fair share of the equity. This dramatically increases the loan amount.

Option 2: Listing with a Realtor – The Traditional Route

For couples focused on maximizing the dollar value of the sale, listing on the MLS is usually the first path considered. However, if your true goal is “selling fast” for separation and finality, the traditional market is fundamentally incompatible with that need.

When you list your home with an agent, you and your ex-spouse remain financially and emotionally tied to that property for the entire duration of the sale process (often 3-6 months).

| The Expectation (Agent Listing) | The Reality (Divorce Sale) |

|---|---|

| Highest Possible Price: The market may yield a high gross offer. | Net Proceeds Shrink: After 6% commissions, closing costs, and repairs, your “take home” cash is significantly lower. |

| Standard Timeline: Typical sales take 45-60 days to close. | Extended Conflict: Arguments over cleaning, showings, and low-ball offers can drag the process out to 6+ months. |

| Joint Decisions: Both parties agree to sell. | Decision Paralysis: Every repair request or showing schedule becomes a potential battleground. |

The Hidden Costs That Eat Away at Your “Higher Price”

Yes, you might get a higher gross sale price through traditional listing. But let’s look at what actually comes out of that:

- Agent Commissions (5-6%): On a $500,000 home, that’s $25,000 to $30,000 right off the top.

- Holding Costs: Every month the house sits, you are both paying mortgage, taxes, and insurance. Three extra months could cost $10,000+.

- Emotional Toll: Can you put a dollar amount on peace of mind?

Option 3: Selling to a Cash Buyer – The Clean Break You Need

When emotional exhaustion has set in, and the thought of negotiating one more detail feels impossible, the Direct Cash Offer provides the cleanest answer. This isn’t about squeezing every last dollar out of the property; it’s about recognizing that your time and mental health are valuable.

The Solution: Speed, Fairness, and Zero Added Conflict

1. It’s Fast: True Finality in 7–14 Days

Because a cash transaction bypasses mortgage approvals and appraisals, you can close in as little as two weeks. In 14 days, you can end the shared mortgage payments and eliminate the financial connection to your ex-spouse.

2. It’s Fair: Immediate, Transparent Financial Split

The agreed-upon cash offer gets split according to your divorce decree immediately at the closing table. No agent commissions. No surprise repair costs. Just a transparent distribution of equity.

3. It’s Simple: We Remove Conflict Sources

No Repairs: We buy as-is. No arguments about who pays for the roof.

No Showings: Your privacy stays intact. No strangers walking through your home.

Streamlined Paperwork: We minimize the back-and-forth between attorneys.

Conclusion

When you’re in the middle of a divorce, you’re not just thinking about real estate—you’re thinking about your future. You want finality. By choosing to work with 123 We Buy House, you’re choosing the quickest, most equitable resolution available. You can’t put a price on being able to sleep at night knowing this chapter is finally closed.

Are you ready to start?

Get a fair, no-obligation cash offer to split your assets and move forward today.