Losing a loved one is difficult enough without having to navigate New York’s complex probate system. If you’ve recently inherited property or have been named executor of an estate, you’re probably wondering: What exactly is probate? How long does it take? And how much will it cost?

This comprehensive guide walks you through every step of the New York probate process, from filing the initial petition to distributing assets. Whether you’re dealing with a straightforward estate or facing complications like real estate holdings across multiple counties, we’ll help you understand what to expect.

What is Probate?

Probate is the legal process through which a deceased person’s estate is settled under court supervision. In New York, this process serves several critical functions:

- Validates the will (or determines heirs if there’s no will)

- Appoints an executor (or administrator if no will exists)

- Identifies and inventories all estate assets

- Pays outstanding debts and taxes

- Distributes remaining assets to beneficiaries

When is Probate Required in New York?

Not every estate requires probate. You’ll generally need to go through probate if the deceased person owned:

- Real estate in their name alone (not jointly owned or in a trust)

- Bank accounts without beneficiary designations exceeding $50,000

- Investment accounts or stocks in their individual name

- Vehicles, boats, or other titled property

- Business interests or partnership shares

When Can You Avoid Probate?

Assets that typically bypass probate include:

- Property held in joint tenancy with right of survivorship

- Assets with designated beneficiaries (life insurance, IRAs, 401(k)s)

- Property in a living trust

- Small estates under $50,000 (may qualify for simplified process)

- Bank accounts with “payable on death” (POD) designations

Types of Probate in New York

New York offers different probate procedures depending on whether the deceased left a will.

| Testate Estate (With a Will) | Intestate Estate (Without a Will) |

|---|---|

| When someone dies with a valid will, the probate process is called “testate.” The will names an executor who manages the estate and beneficiaries who inherit assets. | If someone dies without a will, New York’s intestacy laws determine who inherits. The court appoints an administrator (instead of executor) to handle the estate. Assets are distributed according to a strict legal formula based on family relationships. |

New York Intestacy Law – Who Inherits?

When there’s no will, New York Estate Powers and Trusts Law Section 4-1.1 distributes assets in this order:

- Surviving spouse receives everything if no children

- Spouse and children split the estate ($50,000 to spouse, remainder split)

- Children only if no spouse (divided equally)

- Parents if no spouse or children

- Siblings if no surviving parents

- More distant relatives (nieces/nephews, grandparents, etc.)

If absolutely no relatives can be found, the estate goes to New York State.

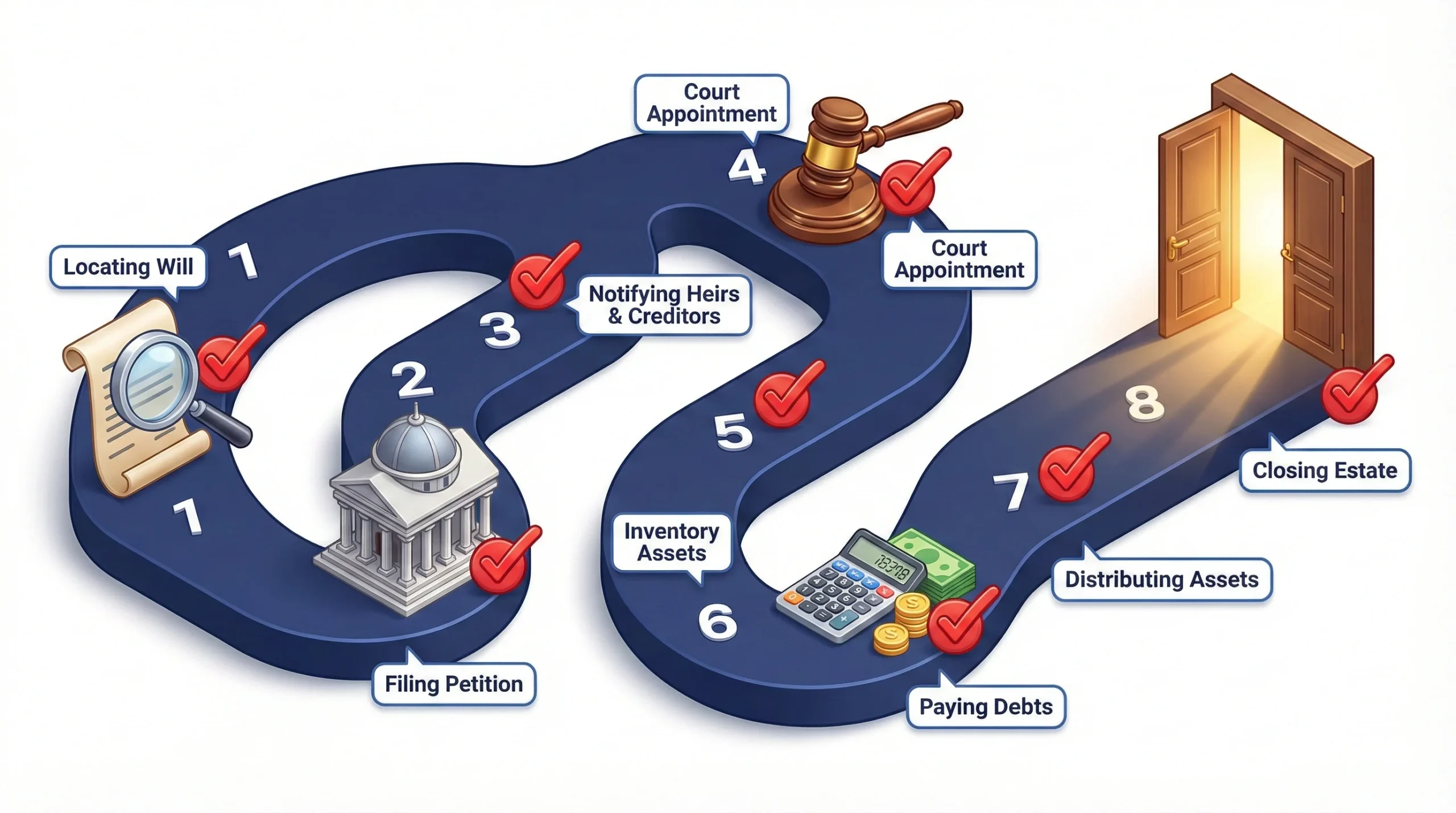

Step-by-Step: The New York Probate Process

The probate process in New York typically involves these stages. Each county Surrogate’s Court may have slightly different procedures, but the overall framework remains consistent.

Step 1: Locate the Will and Death Certificate

Timeline: Immediately after death

Actions Required:

- Obtain multiple certified copies of the death certificate (typically need 6-10 copies)

- Search for the original will (not a copy—courts require the original)

- Identify the named executor (the person responsible for managing the estate)

Common locations for wills:

- Home safe or filing cabinet

- Attorney’s office

- Bank safe deposit box (requires court order to access in some cases)

- New York County Clerk’s office (if the will was deposited for safekeeping)

Step 2: File Petition with Surrogate’s Court

Timeline: Within a reasonable time (no strict deadline, but sooner is better)

Location: File in the Surrogate’s Court of the county where the deceased was domiciled (legal residence) at the time of death.

Required Documents:

- Petition for Probate (Form varies by county)

- Original will and any codicils

- Certified death certificate

- Filing fee (approximately $215 for estates under $500,000; $1,250+ for larger estates)

What the Petition Includes:

- Deceased person’s name, address, date of death

- Names and addresses of all beneficiaries named in the will

- Names and addresses of all surviving family members (even if not in will)

- Estimated value of estate assets

- Request to admit the will to probate

- Request to appoint the named executor

Step 3: Notice to Interested Parties

Timeline: After filing petition

Required Actions:

New York law requires that all “interested parties” receive notice of the probate proceeding. This ensures that anyone with a potential claim can contest the will if necessary.

Who Must Receive Notice:

- All beneficiaries named in the will

- All distributees under intestacy law (family members who would inherit if there were no will)

- Any prior executors named in earlier wills

How Notice is Given:

- Citation: A formal court document notifying interested parties

- Personal service or certified mail: Depending on circumstances

- Publication: If parties cannot be located, notice may be published in designated newspapers

Objection Period:

Interested parties typically have a specific period (often 30 days) to file objections or contest the will.

Step 4: Court Hearing and Appointment

Timeline: 4-8 weeks after filing (if uncontested)

What Happens:

If no objections are filed, the court will schedule a hearing (often brief or waived). The judge will:

- Validate the will (confirm it meets legal requirements)

- Appoint the executor named in the will

- Issue Letters Testamentary (the legal document giving executor authority)

Letters Testamentary:

This official court document proves the executor’s authority to act on behalf of the estate. You’ll need certified copies to:

- Access bank accounts

- Sell real estate

- Transfer stocks or investments

- File tax returns

- Pay creditors

Cost: Certified copies typically cost $6-10 each. Order 6-8 copies initially.

Step 5: Inventory and Appraise Assets

Timeline: Within 6 months (informal guideline)

Executor’s Responsibilities:

The executor must identify, locate, and value all estate assets.

Common Estate Assets:

- Real estate (primary residence, rental properties, vacant land)

- Bank accounts (checking, savings, CDs)

- Investment accounts (brokerage, stocks, bonds)

- Retirement accounts (IRAs, 401(k)s if no beneficiary)

- Life insurance (if payable to the estate)

- Vehicles (cars, boats, motorcycles)

- Personal property (jewelry, art, collectibles)

- Business interests

Appraisal Requirements:

Real estate typically requires professional appraisal (especially if beneficiaries disagree on value or if property will be sold). Obtain appraisals from licensed professionals.

Step 6: Pay Debts and Taxes

Timeline: Ongoing throughout probate

Priority of Payment:

New York law establishes a specific order for paying debts:

- Funeral and administration expenses

- Federal and state taxes

- Medical expenses from final illness

- Secured debts (mortgages, car loans)

- Unsecured debts (credit cards, personal loans)

Notice to Creditors:

Executors should publish a Notice to Creditors in designated newspapers. This starts a claims period (typically 7 months in NY) after which unknown creditors are barred from making claims.

Tax Obligations:

The executor must file several tax returns:

- Final Personal Income Tax Returns:

- Federal Form 1040 (individual)

- New York State IT-201

- Estate Tax Returns (if applicable):

- Federal Estate Tax (Form 706): Required if estate exceeds $13.61 million (2024 exemption)

- New York Estate Tax (Form ET-706): Required if estate exceeds $6.94 million (2024-2025)

3. Estate Income Tax (if estate earns income):

- Form 1041 (federal)

- New York IT-205 (state)

Step 7: Distribute Assets to Beneficiaries

Timeline: After debts paid and tax clearances obtained

Before Distribution:

- Obtain tax clearances from IRS and New York State Tax Department

- Ensure all creditor claims are paid or resolved

- Get court approval if required (some courts require accounting before distribution)

Methods of Distribution:

Specific Bequests:

Items left to specific people (e.g., “I leave my engagement ring to my daughter Sarah”). These are typically distributed first.

Residuary Estate:

Everything remaining after specific bequests and debts. Usually divided among beneficiaries according to percentages in the will.

Real Estate Distribution:

Executors have several options for inherited property:

- Transfer title directly to beneficiaries (if multiple heirs, they become co-owners)

- Sell the property and distribute proceeds (often simpler, avoids co-ownership disputes)

- Allow one beneficiary to buy out others

Documentation:

Provide each beneficiary with a final accounting showing:

- All assets received

- All debts paid

- All distributions made

Step 8: File Final Accounting and Close Estate

Timeline: After all distributions complete

Final Accounting:

Some New York counties require executors to file a formal accounting with the Surrogate’s Court showing all financial transactions. Other counties allow informal accounting with beneficiary approval.

Formal Accounting Includes:

- Detailed list of all assets and values

- All income received by the estate

- All expenses and debts paid

- All distributions made to beneficiaries

Beneficiary Receipts:

Obtain signed receipts and releases from all beneficiaries acknowledging:

- They received their inheritance

- They approve the accounting

- They release the executor from further liability

Court Approval:

After the accounting is approved (formally or informally), the court issues an order discharging the executor and officially closing the estate.

How Long Does Probate Take in New York?

- Simple Estate (uncontested, no real estate): 6-9 months

- Average Estate (one property, no disputes): 9-18 months

- Complex Estate (multiple properties, disputes, or tax issues): 2-4 years

Factors That Affect Timeline:

Delays Probate:

- ❌ Contested will

- ❌ Multiple properties in different counties

- ❌ Estate tax issues

- ❌ Difficult-to-locate beneficiaries

- ❌ Business interests to value

- ❌ Ongoing litigation

- ❌ Family disputes

Speeds Up Probate:

- ✅ Valid, uncontested will

- ✅ Cooperative beneficiaries

- ✅ Simple asset structure

- ✅ Professional executor or attorney

- ✅ Estate below tax thresholds

How Much Does Probate Cost in New York?

Probate expenses typically include:

Court Filing Fees:

- Under $500,000: $215

- $500,000 – $1 million: $1,250

- Over $1 million: Additional fees apply

Attorney Fees:

New York doesn’t have a statutory fee schedule. Attorneys typically charge:

- Hourly: $300-$600/hour (typical for straightforward estates)

- Percentage: 3-5% of estate value (for complex estates)

- Flat fee: $3,000-$10,000+ depending on complexity

Executor Compensation:

New York law allows “reasonable” compensation. Common guidelines:

- 5% of first $100,000

- 4% of next $200,000

- 3% of next $700,000

- 2.5% on amounts over $1 million

(Executors can waive fees, often done when the executor is also a beneficiary)

Other Costs:

- Appraisals: $400-$1,500 per property

- Accounting fees: $500-$3,000

- Bond (if required): $100-$500+

- Publication costs: $200-$500

Total Estimated Costs: 3-7% of estate value for typical estates

Common Probate Challenges in New York

1. Real Estate Complications

Multiple Properties:

If the deceased owned real estate in multiple New York counties, you may need ancillary probate in each county.

Out-of-State Property:

Property located in other states requires ancillary probate in those states, following their probate laws.

Mortgage or Liens:

Properties with mortgages or liens must be handled carefully. The estate must either:

- Continue making payments during probate

- Pay off the mortgage before transfer

- Transfer property subject to the mortgage

2. Family Disputes

Will Contests:

Common grounds for contesting a will in New York:

- Lack of testamentary capacity (person wasn’t mentally competent)

- Undue influence (someone manipulated the person)

- Fraud or forgery

- Improper execution (will doesn’t meet legal requirements)

Contested estates can take 2-5 years to resolve.

3. Beneficiary Issues

Missing Beneficiaries:

If the will names someone who cannot be located, you must make diligent efforts to find them (hire skip tracers, publish notices, etc.).

Minor Beneficiaries:

Inheritances for minors (under 18) may require:

- Court-supervised guardianship

- Custodial accounts under UTMA

- Trust establishment

4. Estate Debt Exceeds Assets

Insolvent Estate:

If debts exceed assets, the estate is “insolvent.” Creditors are paid in legal priority order until funds run out. Beneficiaries receive nothing.

Executors must follow strict legal procedures and should consult an attorney immediately.

Do You Need an Attorney for Probate?

New York law doesn’t require an attorney for probate, but most executors hire one because:

Reasons to Hire an Attorney:

| Reasons to Hire an Attorney | When You Might Not Need an Attorney |

|---|---|

|

|

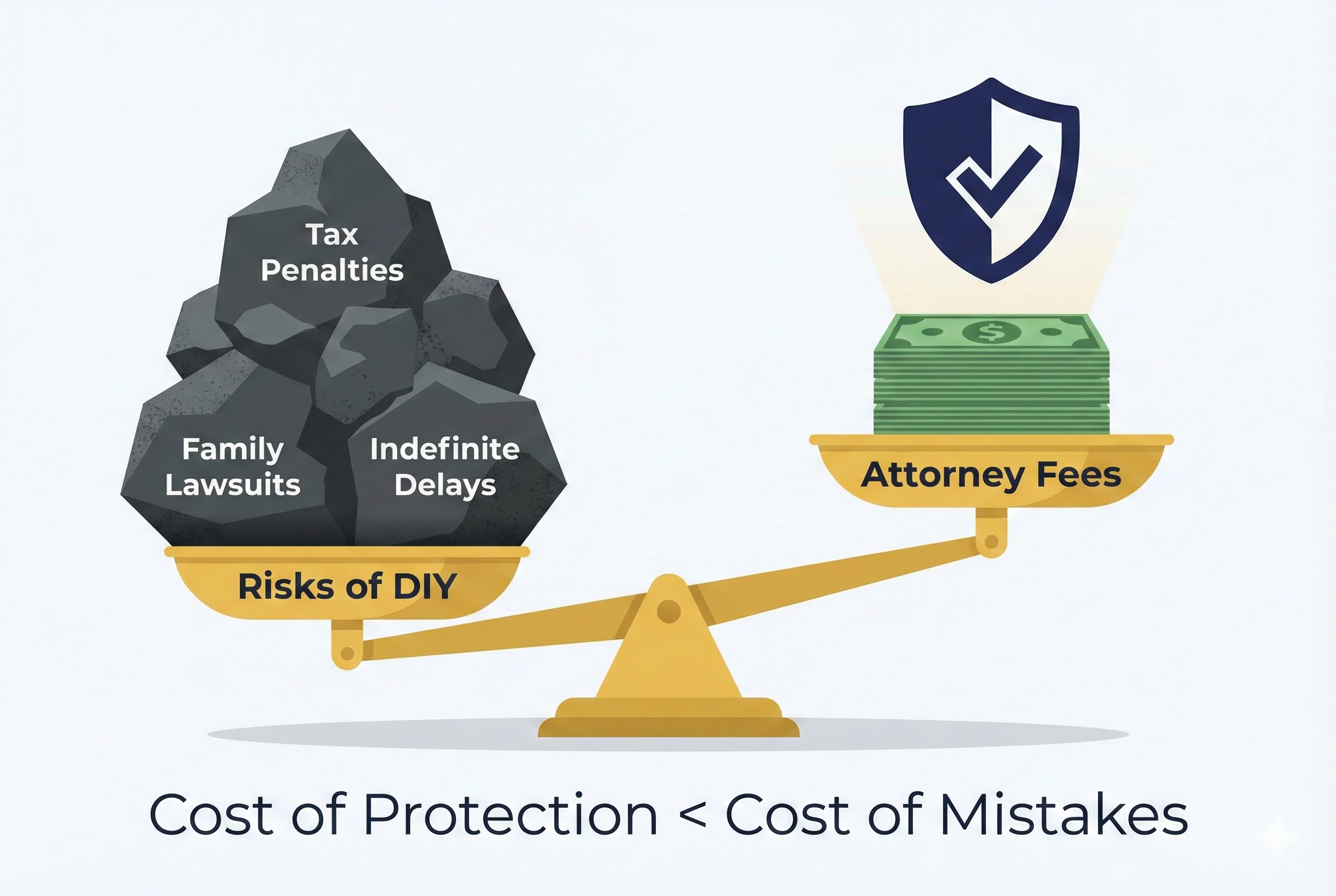

Cost vs. Benefit:

While attorney fees add expense, mistakes can be far more costly. A missed tax deadline, improperly filed document, or procedural error can result in penalties, delays, or personal liability.

Alternatives to Probate in New York

Small Estate Affidavit (Voluntary Administration)

For estates under $50,000 (excluding real estate), you may use a simplified process under SCPA 1301:

- File a voluntary administration proceeding

- Court issues Letters of Administration with limited authority

- Distribute personal property without full probate

- Much faster (2-4 weeks vs. 6+ months)

Transfer on Death Deeds (Not Available in NY)

Note: Unlike some states, New York does NOT allow transfer on death deeds for real estate. Real property must go through probate unless held in a trust or joint ownership.

Special Considerations for Inherited Real Estate

If you’ve inherited a house in New York, you face several decisions:

Option 1: Keep the Property

| Pros (Keeping the Home) | Cons (Keeping the Home) |

|---|---|

|

|

Costs to Consider:

- Property taxes: $5,000-$20,000+ annually (Long Island)

- Homeowners insurance: $1,500-$4,000+ annually

- Utilities and maintenance: $3,000-$10,000+ annually

Option 2: Sell the Property

Many heirs choose to sell, especially when:

- ❌ Property needs repairs they can’t afford

- ❌ Multiple heirs can’t agree on management

- ❌ No one wants to live in or manage the property

- ❌ Property taxes and carrying costs are high

- ❌ Estate needs liquidity to pay debts

Traditional Sale Challenges:

- Takes 3-6 months minimum

- Requires property repairs and preparation

- Involves real estate commissions (5-6%)

- Closing costs (2-3%)

- Must manage property during listing period

- Ongoing carrying costs

Option 3: Sell to a Cash Buyer

For inherited properties in probate, selling to a cash home buyer offers advantages:

Benefits:

- ✅ Close in 7-14 days (vs. 3-6 months traditional)

- ✅ Sell as-is (no repairs, cleaning, or updates needed)

- ✅ Zero commissions (save 5-6%)

- ✅ No closing costs (save 2-3%)

- ✅ Probate coordination (work with executors and attorneys)

- ✅ Multiple heir solutions (fair division of proceeds)

This option is particularly helpful when:

- Estate needs immediate liquidity for taxes or debts

- Property needs extensive repairs

- Heirs live out of state

- Family wants to close estate quickly

Tax Implications of Inherited Property

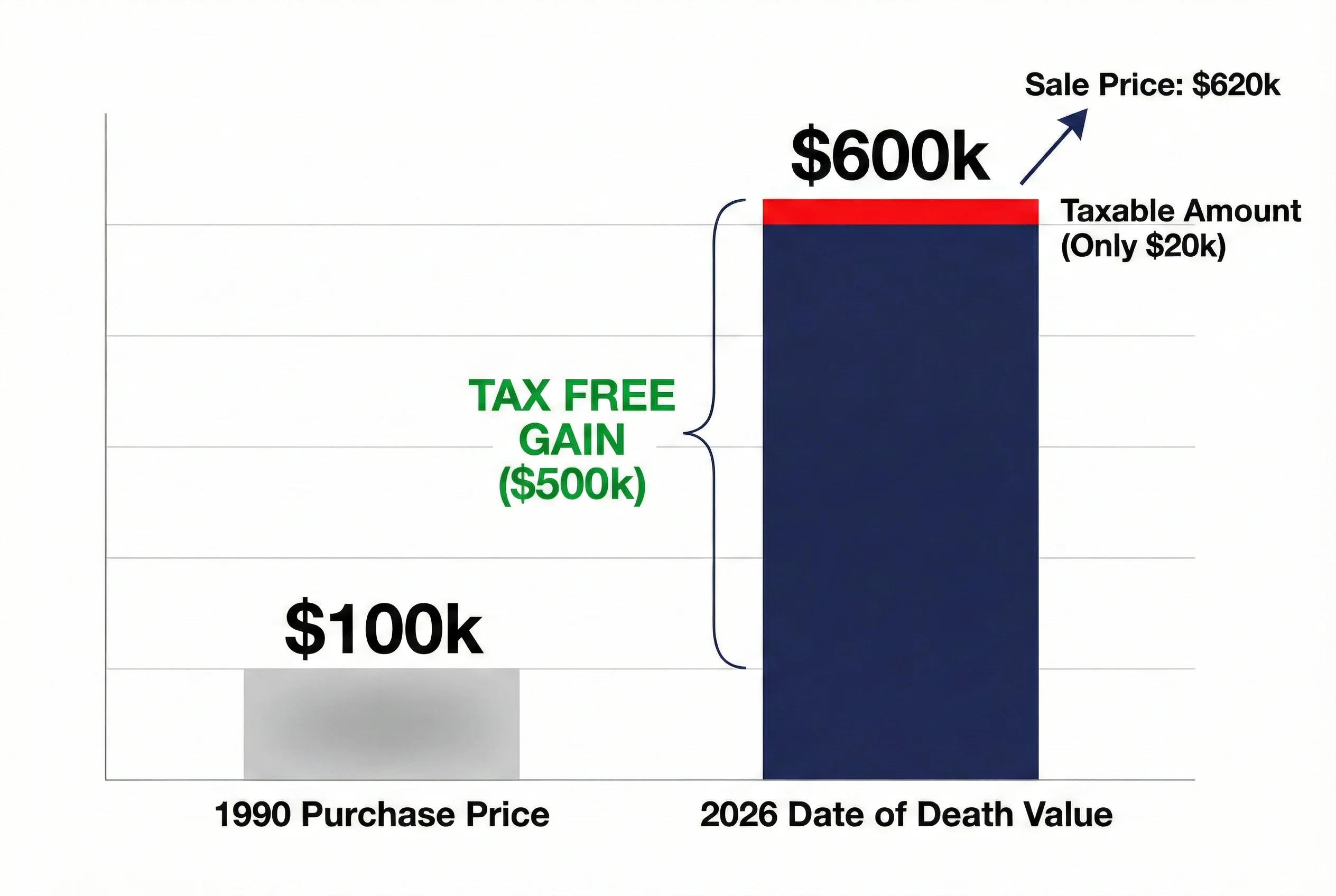

Step-Up in Basis

Inherited property receives a “step-up in basis” to fair market value as of the date of death. This is a significant tax benefit.

Example:

- Deceased bought house in 1990 for $100,000

- House worth $600,000 at death in 2026

- Heir’s basis = $600,000 (not $100,000)

- If heir sells for $620,000, capital gain = only $20,000

Property Tax Exemptions

When you inherit property, check if you qualify to maintain existing exemptions:

- STAR exemption (school tax relief)

- Senior citizen exemptions

- Veterans exemptions

Contact your local assessor’s office to transfer or apply for exemptions.

Rental Income

If you rent the inherited property during probate, that income is taxable to the estate (not to you personally) and must be reported on Form 1041.

Are you ready to start?

Handling probate can be overwhelming. If you need to liquidate real estate assets quickly, we are here to help.

Frequently Asked Questions

Q: Can I live in the house during probate?

+

Maybe. If you’re a beneficiary, the executor may allow you to live there, but:

- The estate may charge rent (to preserve estate value for all beneficiaries)

- You may be responsible for utilities and maintenance

- You must vacate when the property is sold or distributed

Get written permission from the executor.

Q: What if I can’t afford the inherited property taxes?

+

If you can’t afford to keep the property:

- Sell quickly to avoid accumulating debt

- Disclaim the inheritance (must be done within 9 months of death)

- Negotiate with other heirs to buy out your share

Don’t ignore property tax bills—they accumulate interest and can result in tax liens or foreclosure.

Q: Can the executor sell the house without my permission?

+

It depends on the will. If the will grants the executor power of sale, they can sell without beneficiary approval. If the will is silent, executors typically need court approval or beneficiary consent to sell real estate.

Q: What happens if one heir wants to keep the house and others want to sell?

+

Options include:

- Buyout: The heir who wants to keep it buys out the others’ shares

- Partition action: Court-ordered sale if heirs cannot agree

- Negotiated solution: Heirs negotiate terms (sometimes one heir lives there and pays others rent)

Conclusion: Navigate Probate with Confidence

The New York probate process can feel overwhelming, but understanding each step helps you move forward with confidence. Whether you’re an executor managing an estate or a beneficiary inheriting property, remember:

- Take it one step at a time – probate is a marathon, not a sprint

- Seek professional help when needed – attorneys and CPAs protect you from costly mistakes

- Communicate clearly with beneficiaries – transparency prevents disputes

- Keep detailed records of all transactions

- Don’t rush major decisions about inherited property

Need to Sell an Inherited House in New York?

If you’ve inherited property in Nassau County, Suffolk County, Queens, or Brooklyn and need to sell quickly during or after probate, we can help.

We specialize in probate property sales:

- ✅ Work directly with executors and attorneys

- ✅ Buy properties in any condition (as-is)

- ✅ Close in 7-14 days (or on your timeline)

- ✅ Handle properties with multiple heirs

- ✅ Zero commissions or closing costs

- ✅ Fair cash offers based on current market value

We understand the challenges of inherited property—from family dynamics to property condition to probate deadlines. Our process is simple, transparent, and designed to help you close the estate and move forward.

Learn more about selling your inherited house →

Or call us at 516-605-3001 for a free, no-obligation consultation.

Disclaimer: This article provides general information about New York probate law and is not legal advice. Probate laws and procedures vary by county and individual circumstances. Consult with a licensed New York estate attorney for guidance specific to your situation.

Sources:

- New York Surrogate’s Court Procedure Act (SCPA)

- New York Estates, Powers and Trusts Law (EPTL)

- New York State Unified Court System – Surrogate’s Court

- New York State Department of Taxation and Finance